Managing Leaves of Absence

Details

In order to manage leaves of absence (LOA) in your HRIS system, Namely recommends using custom fields to collect LOA-related data.

While the custom fields are an excellent way to track LOA data, please be mindful of any payroll and benefits administration ramifications your data may have.

Stay up to date

Always stay up to date with COVID-19: Consolidated Appropriations Act Updates for 2021.

Namely Recommended Custom Fields for LOA

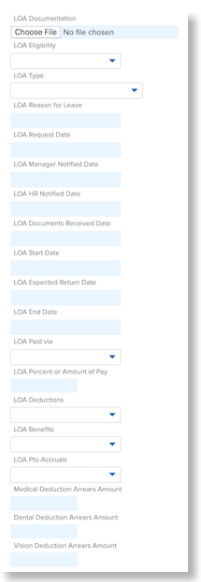

Custom fields may be used to capture all different types of information around LOA, including a Start Date, Expected Return Date, End Date, any balances of LOA/FMLA time, and any information that will help you track payroll ramifications, including whether the employee will continue to be paid via Namely Payroll or who is responsible for the employee's deductions during their LOA.

The following image displays Namely's recommended setup up for LOA custom fields:

For more information on setting up custom fields that will work for your organization, please see: Configuring Profile Fields.

Note: as with all custom fields, you can create workflows so that your employees can enter LOA details themselves, then you can review the data before approving. For more information on setting up workflows, please see: Creating a Workflow.

Custom Field Descriptions and Picklist Options

-

LOA Documentation

-

This field can be used to store any federal/state/carrier documentation.

-

-

LOA Eligibility

-

This field may be based on an employee's job classification or other determining factor.

-

Recommended selections include:

-

Eligible

-

Ineligible

-

-

-

LOA Type

-

Details type of leave.

-

Recommended selections include:

-

Parental Leave

-

Sick

-

FMLA

-

Furlough

-

Federal Paid Medical Leave - Tier 1

-

Federal Paid Medical Leave - Tier 2

-

Federal Paid Family Leave

-

Non FMLA (Personal/Sabbatical)

-

-

-

LOA Reason for Leave

-

Text field for any additional information you would like to add.

-

-

LOA Request Date

-

Date request made to HR.

-

-

LOA Manager Notified Date

-

Date manager first informed of request.

-

-

LOA HR Notified Date

-

Date HR team first informed of request.

-

-

LOA Documents Received Date

-

Date pertinent documents (e.g., from LOA administrator) received.

-

-

LOA Start Date

-

Date leave begins.

-

-

LOA Expected Return Date

-

Return date as estimated when leave begins.

-

-

LOA Return Date

-

Actual Return Date.

-

-

LOA Paid Via

-

How is an employee being paid?

-

Recommended selections include:

-

Via Namely

-

3rd Party

-

Unpaid

-

-

-

LOA Percent or Amount of Pay

-

Percent of pay or per pay period amount employee is being paid.

-

-

LOA Deductions

-

How are deductions being handled?

-

Recommended selections include:

-

Tracked in arrears

-

Paid by employee via check

-

Paid by employee via payroll deductions

-

Paid by employer

-

Cancelled

-

-

-

LOA Benefits

-

Is an employee still eligible for benefits?

-

Recommended selections include:

-

Active

-

Inactive

-

COBRA

-

-

-

LOA PTO Accruals

-

Is an employee eligible to continue accruing PTO?

-

Recommended selections include:

-

Active

-

Inactive

-

-

-

Medical Deduction Arrears Amount

-

Area for client to manual update accrued deduction amount.

-

-

Dental Deduction Arrears Amount

-

Area for client to manual update accrued deduction amount.

-

-

Vision Deduction Arrears Amount

-

Area for client to manual update accrued deduction amount.

-

Notes:

-

Marking an employee as Inactive will have two downstream effects to consider:

-

PTO will stop accruing; if an Inactive employee is made Active again, PTO balances may need to be updated manually.

-

If that employee is the approving manager for any pending workflow requests, those workflow requests should be deleted, then the employee should re-submit after they have been assigned to a new, active manager.

-

-

While these fields and picklist options are Namely recommended, additional fields may be needed by your organization based on your LOA options (e.g., fields for deductions arrears for additional benefits).

-

Once any of these fields have been created, you are able to import data into these fields.

Payroll and Benefits Considerations around LOA

While these custom fields will live in HRIS, data entered here may have an impact on your payroll or benefits administration processes. Please see the following table for a list of further system actions you may need to take depending on your selection:

|

Custom Field |

Selection |

Subsequent Action In HCM |

Subsequent Action In Payroll |

Subsequent Action in Benefits |

Notes |

|

LOA Documentation |

File Upload for LOA Documents |

Upload Documents |

|

|

May need more than one field |

|

LOA Eligibility |

Eligible |

Select This Employee Status |

|

|

|

|

Ineligible |

Select This Employee Status |

|

|

|

|

|

LOA Type |

Parental Leave |

Select This Leave Type |

|

|

|

|

FMLA |

Select This Leave Type |

|

|

|

|

|

Furlough |

Select This Leave Type |

|

|

|

|

|

Sick |

Select This Leave Type |

|

|

|

|

|

Federal Sick Leave (Type 1 thru 3) |

Select This Leave Type |

|

|

|

|

|

Federal Sick Leave (Type 4 thru 6) |

Select This Leave Type |

|

|

|

|

|

Federal Family Leave |

Select This Leave Type |

|

|

|

|

|

Non-FMLA (Personal/Sabbbatical) |

Select This Leave Type |

|

|

|

|

|

LOA Reason for Leave |

Text Field |

Enter any additional details |

|

|

|

|

LOA Request Date |

Date Field |

Enter Appropriate Date |

|

|

|

|

LOA Manager Notified Date |

Date Field |

Enter Appropriate Date |

|

|

|

|

LOA HR Notified Date |

Date Field |

Enter Appropriate Date |

|

|

|

|

LOA Documents Received Date |

Date Field |

Enter Appropriate Date |

|

|

|

|

LOA Start Date |

Date Field |

Enter Appropriate Date |

|

|

|

|

LOA Expected Return Date |

Date Field |

Enter Appropriate Date |

|

|

|

|

LOA End Date |

Date Field |

Enter Appropriate Date |

|

|

|

|

LOA Paid Via |

Namely |

N/A |

Upload/key as additional pay or use normal Salary field |

|

|

|

3rd Party |

Uncheck "Include in Payroll" if no pay at all through Namely |

Reduce or zero out normal Salary if needed. Client to provide 3rd Party Pay Data it applicable for BOL entry. |

|

|

|

|

Unpaid |

Uncheck "Include in Payroll" if no pay at all through Namely |

Can zero out salary if paying other items, or remove from payroll completely via HRIS |

|

|

|

|

LOA Percent or Amount of Pay |

% of flat $ |

Update per pay period or hourly wage |

Update recurring earnings if applicable |

|

|

|

LOA Deductions |

Tracked in Arrears |

Must manually update field for accrued arrears amounts |

Must end date deductions if not actively taking or suppress manually in each payroll |

|

|

|

Paid by Employee |

|

If EE is paid via Namely, process as normal. If EE is unpaid or paid by 3rd party, EE to provide client check for deduction cost and amount to be recorded in BOL. |

|

|

|

|

Paid by Employer |

|

If EE is paid via Namely, process as normal. If EE is unpaid or paid by 3rd party, ER portion will need to be manually tracked and sent to carrier. Amount will need to be provided by client to record in BOL> |

|

|

|

|

Cancelled |

|

Must end date deductions if not actively taking or suppress manually in each payroll |

|

|

|

|

LOA Benefits |

Active |

|

|

|

|

|

Inactive |

|

|

Must end benefits by doing an admin change or move employee to a benefits-ineligible class |

|

|

|

Cobra |

|

|

Must end benefits by doing an admin change or move employee to a benefits-ineligible class |

|

|

|

LOA PTO Accruals |

Active |

You can either update the User status or re-assign the user to all plans and manually add the carryover and accrual amounts housed within custom fields back into the plans |

|

|

|

|

Inactive |

You can either update the User status or unassign the user from all plans while preserving their PTO accruals and carryover amounts in Custom fields |

|

|

|

|

|

Medical Deduction Arrears Amount |

Amount Field |

Must manually update field for accrued arrears amounts |

Must end date deductions if not actively taking or suppress manually in each payroll |

|

Can catch employees up in future by manually adjusting deduction amounts in Step 2 of payroll. |

|

Dental Deduction Arrears Amount |

Amount Field |

Must manually update field for accrued arrears amounts |

Must end date deductions if not actively taking or suppress manually in each payroll |

|

Can catch employees up in future by manually adjusting deduction amounts in Step 2 of payroll. |

|

Vision Deduction Arrears Amount |

Amount Field |

Must manually update field for accrued arrears amounts |

Must end date deductions if not actively taking or suppress manually in each payroll |

|

Can catch employees up in future by manually adjusting deduction amounts in Step 2 of payroll. |

LOA Management Example

If you have an employee who is going on a Federal Paid Medical Leave (Type 2) who will be paid entirely by a third party, but will be paying you directly for their benefits premiums, you would use the custom fields as such:

-

Upload any appropriate documentation in LOA Documentation

-

Select Eligible for LOA Eligibility.

-

Select Federal Paid Medical Leave - Tier 1 for LOA Type

-

Enter any additional details about the leave in LOA Reason for Leave.

-

Enter all appropriate dates in LOA Request Date, LOA Manager Notified Date, LOA HR Notified Date, LOA Documents Received Date, LOA Start Date, LOA Expected Return Date, LOA End Date.

-

Select Third Party for LOA Paid Via

-

Per the table:

-

Uncheck "Include in Payroll" in HRIS

-

Reduce or zero out normal salary, if necessary

-

Send any pay data to Service if YTD amounts need adjustment because of third-party payments

-

-

-

Enter $0 for LOA Percent or Amount of Pay

-

Select Paid by Employee for LOA Deductions

-

Per the table:

-

Employee will need to send any deduction payments directly to you

-

Send any deduction data to Service if YTD amounts need adjustments because of employee's direct payments.

-

-

-

Select Active for LOA Benefits.

-

Select Active or Inactive for LOA PTO Accruals.

-

Per the table, please keep in mind that you may need to change the user's status or manually adjust accruals to account for selection.

-

-

Medical, Dental, and Vision Deduction Arrears Amounts would be $0 in this instance, as the employee is making payments for their benefits, but you would use this fields to record any money owed by the employee for these deductions.